June Mahindra & Mahindra continued its good show in the passenger vehicle market in India, securing the second spot for the third month running. The SUV specialist sold 47,306 units in the country, representing a strong 18.2% YoY growth despite challenging market environment.

Key Performance Highlights

Mahindra’s performance in June 2025 reflects the company’s robustness in a difficult market situation. Against a 6.4% fall in the total passenger vehicle industry, Mahindra defied the trend with robust double-digit growth. Enlarged market share to the tunes of 14.9% from 11.8% in June 2024 consolidating its position as India’s second largest passenger vehicle manufacturer.

Although a year-on-year growth, Mahindra saw a 9.8% on month dip from 52,431 units down in May 2025. This weakness is in line with the seasonal trend observed in the entire industry; June is a month of lower sales owing to monsoon commencement, and the Beginning of Ashadha in South India is inauspicious.

Model-wise Sales Breakdown

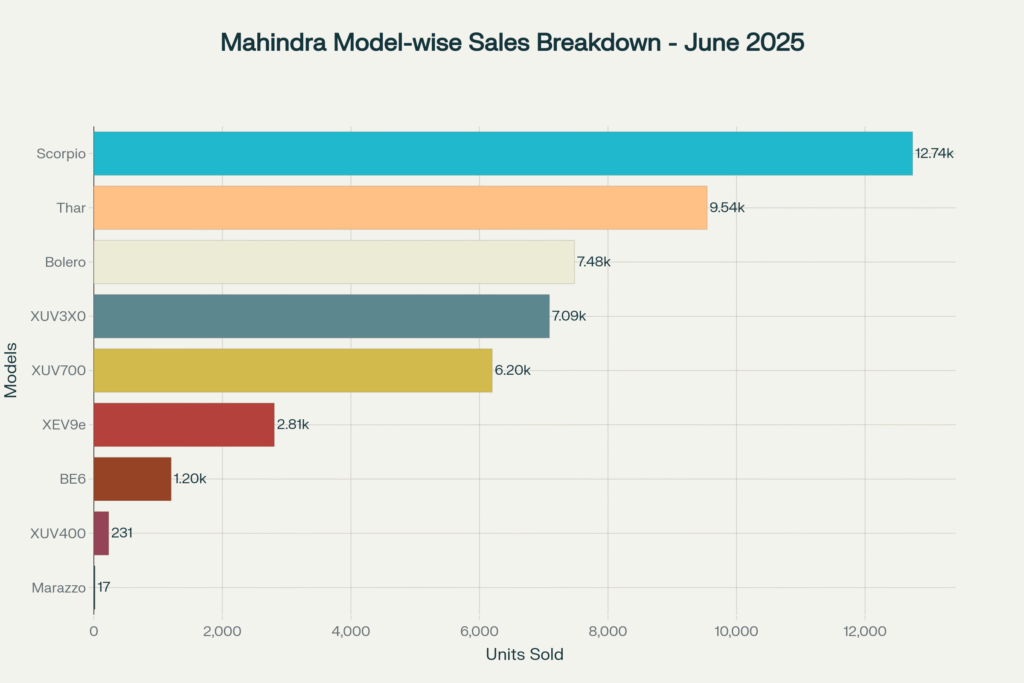

Breakdown of Mahindra sales figures model-wise for June 2025 (Scorpio on top with 12,740 units)

Mahindra sold a total of 12,740 units of the Scorpio last month of its sales tally last month.

The Scorpio continued as Mahindra’s best-seller, recording 12,740 units in June 2025, a marginal 4 per cent year-on-year growth. The performance of Scorpio remains sturdy and consistent, bearing testimony to new Scorpios’ impressive overall package, making it a popular choice with customers both in the urban and rural markets.

The ace performer from the bunch was the Thar with 9,542 units registering a year-on-year increase of 77%. This impressive growth can be credited to the hugely successful introduction of the Thar Roxx in its five-door avatar that has elongated the model’s market acceptance way beyond its core fanbase.

Bolero, Mahindra’s rural workhorse SUV, chipped in 7,478 units posting a sustainable growth of 2% y-o-y. The rural market continues to be the dominated by this model pulling on the back of better agricultural conditions and growth in rural incomes.

Product Performance Analysis

The XUV3X0 reported 7,089 units last month, a 17 per cent YoY fall compared with 8,500 units it had sold in June 2024. Even with this little ebb, the compact SUV has proven its worth in the sub-4-meter territory which is populated by the Hyundai Venue and Tata Nexon.

The XUV700 posted sales of 6,198 units, indicating a robust 5% year-on-year growth. The luxury SUV is still appealing to drivers looking for high-end amenities and stylish design in a 3-row package.

Electric Vehicle Momentum Builds

Mahindra and its launche of electric vehicles were telling with a very strong show in June 2025. XEV 9e saw sales of 2,808 cars whilst BE 6 added sales with 1,203 cars. This is a decent traction for models that were introduced in the beginning part of the year–and a testament to the increasing adoption of Mahindra’s electric-birthed SUVs.

Cumulative EV dispatches stood at 19,070 units (to dealers) in H1FY25, of which the combined sales of BE 6 and XEV 9e surpassed the 4,000-mark in June. This has played a role in Mahindra’s securing of a 17 percent share in India’s electric passenger vehicle marketplace.

Read Also: Hyundai Creta Reclaims Top Spot In June 2025 SUV Sales

Market Context and Competitive Landscape

Mahindra’s strong numbers come at a time when auto market conditions remain challenging. Maruti Suzuki, the industry leader, saw sales plummet 13.3% y-o-y at 1,18,906 units, and the growth trend of Mahindra underscored an emerging preference for SUVs as against regular hatchbacks.

The company’s leapfrog over Hyundai for second also represents the broader state of affairs in the market: The SUV-focused makers are lifting while those which lean heavily on sedan and hatch market segments are being hit on the chin. Hyundai sold 44,024 units registering a minuscule MoM growth of 0.4 per cent, but it posted a YoY decline of 12.1 per cent.

Rural Market Resurgence

Rural market rebound has played a huge role in Mahindra’s strong show. Early onset of monsoon and better earnings from Rabi crop, and good prospects of Kharif season so far, have led to augmented purchasing power in rural areas. The return of rural is being enjoyed by the likes of Mahindra, whose utility-oriented product range strikes a chord with consumers in semi-urban and rural areas.

Its tractor business showcased its rural optimism with 51,769 units, sold in June 2025, up 13% YoY. Such agricultural-sector performance is commonly related to demand for passenger vehicles in rural markets.

Strategic Outlook

And Mahindra’s June 2025 performance will only help the company fortify its position as India’s No. 1 SUV maker. The product strategy, which has been hinging around utility vehicles across price segments, remains unbiased toward changing consumer tastes.

With impressive results for electric models XEV 9e and BE 6, Mahindra is on the right track to meet the rising tide of EVs. With support of the EV sales momentum and sustained power in the conventional SUV segment, the company looks to hold on to its number 2 position in the India passenger vehicle market.